Best Financial Planner Melbourne Fundamentals Explained

Wiki Article

Getting The Melbourne Finance Broker To Work

Table of ContentsFacts About Melbourne Finance Broker RevealedUnknown Facts About Melbourne Finance BrokingBest Financial Planner Melbourne Things To Know Before You BuyWhat Does Melbourne Finance Broker Do?The smart Trick of Finance Brokers Melbourne That Nobody is Talking AboutBest Financial Planner Melbourne Can Be Fun For Anyone

The marketing of mortgage in the wholesale or additional market is more typical. They give long-term resources to the customers. A "straight lender" may provide straight to a consumer, yet can have the financing pre-sold prior to the closing. Couple of lenders are extensive or "profile lending institutions". That is, few close, keep, and service the home mortgage loan.An excess would activate added disclosures and cautions of danger to a consumer. Further, the home mortgage broker would have to be a lot more certified with regulators. Expenses are likely lower as a result of this guideline. [] Home mortgage lenders and financial institutions are exempt to this expense decrease act. Because the selling of financings generates the majority of lender fees, servicing the total for the most part exceeds the high expense act.

This results from the hold-up of offering the servicing till after closing. Therefore, it is taken into consideration a secondary market purchase and exempt to the exact same guideline. Since 2007, in the USA the federal regulation and a lot of state regulations do not designate a fiduciary duty on home loan brokers to act in benefits of their consumers.

Some home loan brokers have actually been involved in mortgage scams according to the FBI.

All About Melbourne Finance Broking

The majority of districts require mortgage brokerage business to carry a rural certificate. Mortgage Brokers in Nova Scotia are accredited by Solution Nova Scotia and are controlled under the Home mortgage Brokers and Lenders Enrollment Act. Numerous brokers in Nova Scotia are participants of the Mortgage Brokers Association of Atlantic Canada. Even more info concerning the different mortgage programs that are offered to consumers can be found at Mortgage Supervisors.

While the terms Home loan Broker and Mortgage Representative are comparable, and Home mortgage Brokers and Home loan Representatives meet numerous of the exact same functions, it is very important note that there remains in reality a difference. According to Canadian Mortgage Trends the main difference in between a Home mortgage Broker is that, "... a home mortgage broker is a firm or individual certified to handle home loans and employ mortgage representatives" while "A home loan agent is a specific authorized to handle home loans on behalf of a mortgage broker.

Some home mortgage brokers charge a cost to their clients.

Some Of Best Financial Planners Melbourne

The broader distinction my sources in between customers and services taken on within the MCD is, in some areas, unlike the present UK structure, and therefore some exceptions formerly appreciated in the UK will certainly be phased out. One instance is where customers or relatives of debtors will inhabit much less than 40% of a property, which is presently ruled out regulated organization; by 2016, such borrowers will be thought about customers.

It is speculated that, since debtors' applications are stress-tested on the toughness of their ability to make the monthly payments, boosting varieties of consumers are choosing home mortgage terms going beyond the conventional 25 years. This leads to reduced repayments however a higher general rate of interest expense, in addition to a longer duration servicing financial obligation.

About 35% of all financings protected by a mortgage in Australia were presented by home loan brokers in 2008.

About Finance Brokers Melbourne

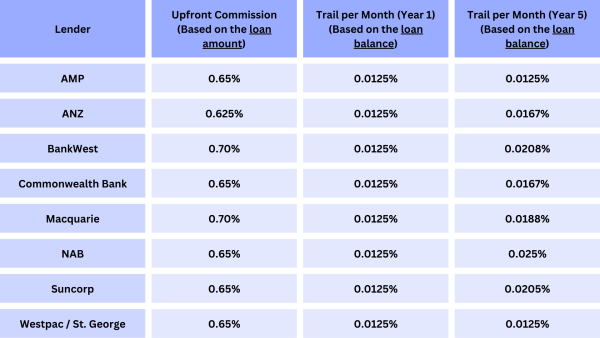

In 20162017, home loan brokers had actually contributed to $2. 9 billion to Australian economy.165% of the loan amount per year paid monthly. These compensations can differ dramatically between different lenders official website and car loan items, particularly considering that the compensation re-alignments introduced by Australian financial institutions during June to August, 2008 in reaction to the Subprime home loan crisis. Although mortgage brokers are paid compensations by the loan providers this does not alter the final rate or costs paid by the consumer as it might in other countries.

The quantity is normally 0. 66% of the funding amount for loans paid back in the first 12 months and 0.

The more comprehensive distinction in between customers and services adopted within the MCD is, in some aspects, unlike the present UK framework, and as a result some exceptions previously see here appreciated in the UK will be terminated (best financial planners melbourne). One example is where consumers or family members of consumers will certainly occupy less than 40% of a building, which is presently not considered regulated company; by 2016, such consumers will be taken into consideration customers

Melbourne Finance Broker Fundamentals Explained

It is speculated that, because customers' applications are stress-tested on the toughness of their capacity to make the month-to-month repayments, boosting varieties of debtors are opting for home loan terms surpassing the conventional 25 years. This results in lower repayments yet a greater total passion bill, in addition to a longer period servicing debt.Around 35% of all financings safeguarded by a home mortgage in Australia were presented by home loan brokers in 2008.

165% of the lending quantity per year paid monthly. These payments can vary considerably between different lending institutions and finance items, especially given that the payment re-alignments presented by Australian banks throughout June to August, 2008 in reaction to the Subprime mortgage situation. Home mortgage brokers are paid payments by the lenders this does not modify the final price or charges paid by the consumer as it may in other nations.

The 9-Second Trick For Best Financial Planner Melbourne

The amount is normally 0. 66% of the lending amount for car loans paid back in the first 12 months and 0.Report this wiki page